For most taxpayers the credit for investing in renewable energy property was repealed effective for renewable energy property placed in service on or after january 1 2016 taxpayers that met the requirements of g s.

Nc solar tax credit 2017.

While every effort is made to ensure the accuracy and completeness of the.

Those numbers are in stark contrast to general assembly estimates in 2007 when lawmakers passed senate bill 3.

And a record 245 million in 2016.

The most credits claimed before the program phase out was 136 million in 2015.

The north carolina general assembly offers access to the general statutes on the internet as a service to the public.

The state used to offer a 35 tax credit to investors in renewable energy projects.

75 cents watt for nonprofit customers.

Any customer of duke energy whose new solar installation is interconnected to the grid after january 1 2018 is eligible to apply for the rebate but certain restrictions apply.

An average 6 kilowatt kw system would be eligible for a rebate of 3 600.

209 million in 2017.

The legislation created the tax credit program and set a percentage of renewable energy use utilities had to meet over time.

There may still be other local rebates from your city county or utility.

Tax credits for growing businesses article 3j.

Revenue department data show the state issued 210 million in credits for calendar year 2018.

50 cents watt for commercial customers.

60 cents watt for residential customers.

Statistical abstract of north carolina taxes 2015.

Considering installing solar panels at your home in north carolina.

For homeowners the program offers a 0 60 watt rebate for systems up to 10 kilowatts.

2017 cost index and depreciation schedules.

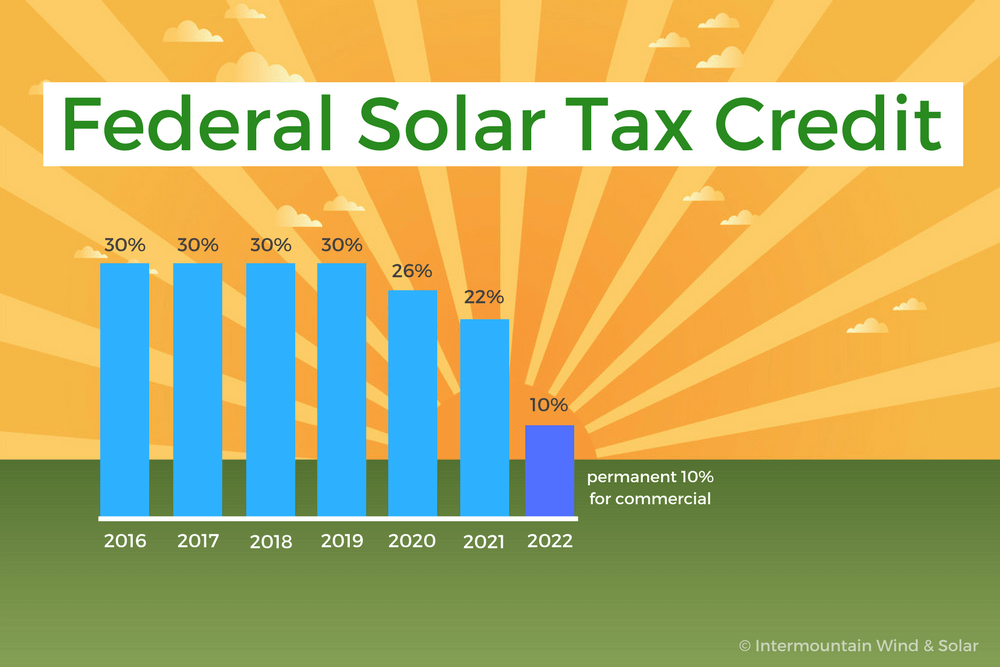

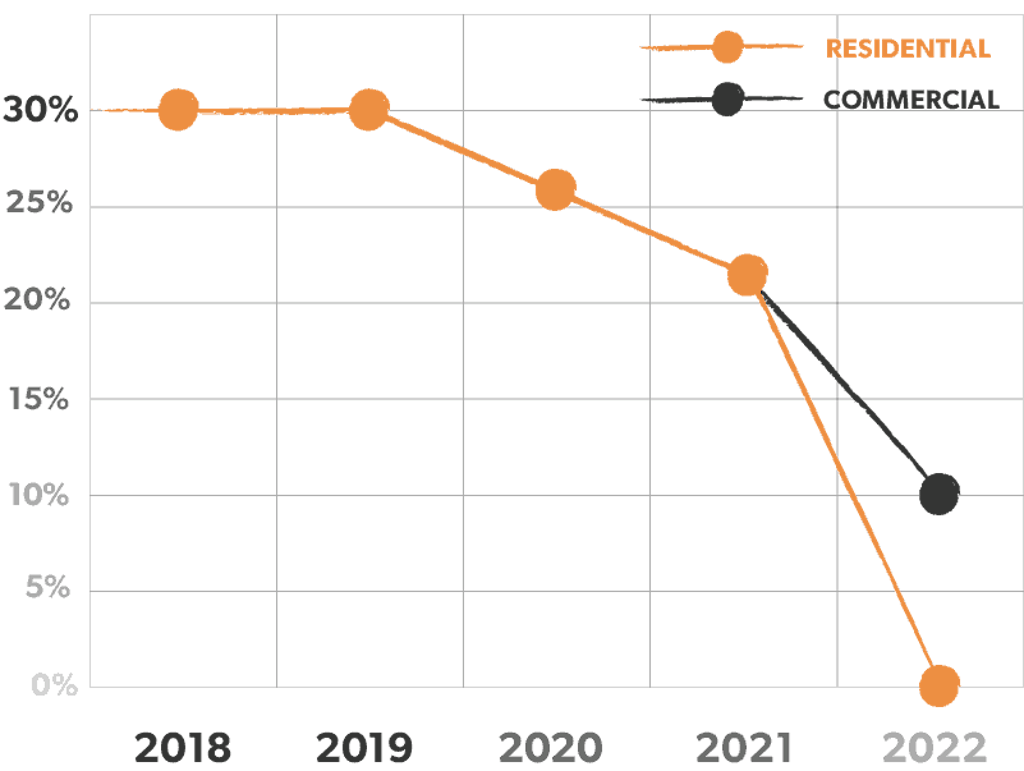

All of north carolina can take advantage of the 26 federal tax credit which will allow you to recoup 26 of your equipment and installation costs for an unlimited amount.

The tax credit along with other state polices encouraging renewable energy helped make north carolina one of.

The state s renewable tax credit was one of the most generous in the nation cutting the cost of a renewable energy project by 35 percent up to 2 5 million per facility for businesses.

North carolina solar tax credit expanded for 1 year wednesday april 29 2015 raleigh wtvd with the stroke of his pen wednesday governor pat mccrory extended north carolina s renewable energy.